EXIT PLANNING FOR SMALL-MEDIUM BUSINESSES IN WESTERN CANADA

Exit Planning: Build a Business That Gives You Options

The same strategies that prepare you for a successful exit also make your business more profitable & enjoyable to run today. Whether you exit in 2 years or 10 years—start now.

Most business owners think exit planning is something you do when you're ready to sell.

But here's the truth: by then, it's too late to maximize value and too late to decide if selling is even the right choice.

Exit planning isn't just about preparing to sell your business.

It's about building a company that's valuable, transferable, and runs without you—giving you the freedom to exit proudly, stay strategically, or scale further on your terms.

You gain options, not obligations.

30 minutes. No pressure.

Discover your options to start preparing today.

The Reality of Business Exits

Selling your business should be the culmination of years of hard work—a moment of pride, freedom, and financial security. But for most owners, it's not.

Research shows that 75% of business owners regret their exit within 12 months.

Why?

THEY WEREN’T READY

Financially: They left significant money on the table because their business wasn't optimized for valuation.

The same profit can sell for wildly different multiples based on how the business is structured.

Operationally: Their business depended on them, which reduced buyer interest and drove down the sale price.

Buyers always ask: "Could this business run for 90 days without you?"

Personally: They hadn't thought through life after exit—leading to identity crisis, boredom, and deep regret.

They had no clear vision of what came next.

Companies that commanded premium valuations and left owners satisfied had one thing in common: they started preparing years in advance.

Why 75% of Business Owners Regret Selling Within a Year

“64% of Canadian businesses have no formal succession plan”

“70%+ of businesses listed for sale never actually sell”

“80%+ of business owner’s wealth is tied up in the value of their business”

“75% regret selling within one year”

What is Exit Planning?

Exit Planning Is Strategic Preparation, Not Just Selling

Exit planning is the process of systematically building a business that's:

Valuable - Worth significantly more to acquirers

Transferable - Runs successfully without you

Scalable - Grows predictably with strong systems

Attractive - De-risked and appealing to multiple buyer types

But here's what most people miss: The same strategies that prepare you for a successful exit also make your business more profitable and enjoyable to own today.

When you build systems that run without you, create a strong leadership team, improve margins, and document processes—you don't just increase company value. You gain freedom.

Exit Planning Gives You 3 Possible Outcomes:

1: Exit Proudly

Sell your business at a premium valuation, on your timeline, with pride and no regrets.

Transition smoothly to your next chapter with financial security and fulfillment. Walk away knowing you built something valuable and transferred it successfully.

2: Stay Strategically

Discover that once your business doesn't depend on you, ownership becomes enjoyable again.

Stay and run it on your terms - working less, earning more, with real freedom. Many owners fall back in love with their business once it stops running them.

3: Scale Further

Use your newfound operational excellence to grow bigger, bring in partners, transition to family, or build your next venture while this one runs itself.

Your optionality expands exponentially.

You don't have to decide which path you'll take today. Exit planning gives you options.

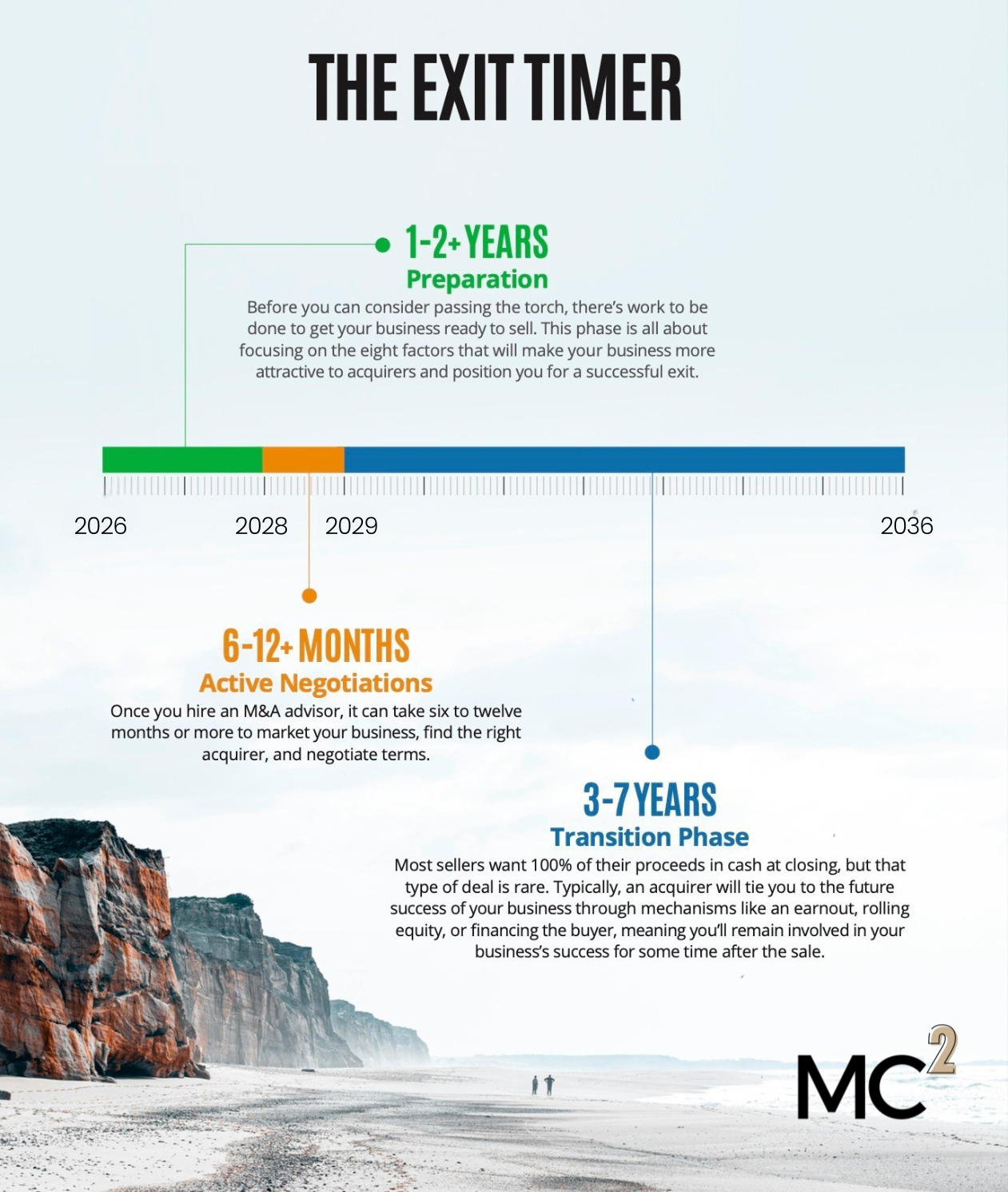

THE EXIT PLANNING TIMELINE

How Long Does It Really Take to Prepare for Exit?

Most business owners dramatically underestimate the timeline.

Selling a business isn't a 6-month sprint—it's a multi-year journey with distinct phases.

Phase 1: PREPARATION (1-2+ Years)

Before you can even consider passing the torch, there's work to be done. This phase is all about making your business bankable—attractive to acquirers and positioned for a successful exit.

In this phase, you'll:

Get your house in order: clean financials, documented systems, strong team

Reduce owner dependency systematically

Improve the 8 key drivers of company value

Build recurring revenue and diversify your customer base

Strengthen margins and cash flow

Why it matters:

This is where value is created. The work you do in this phase directly determines whether you'll get top dollar or leave money on the table.

Phase 2: NEGOTIATION (6-12 Months)

Once you hire a Broker or M&A advisor, the clock starts ticking. You'll create a confidential information memorandum (the 20-30 page deck that 'sells' your business), identify and approach potential buyers, field offers, and negotiate deal structures.

This phase includes:

Valuation and marketing package preparation

Buyer outreach and screening

Letter of Intent (LOI) negotiations

Due diligence process

Final deal structuring

Why it matters:

Even with a strong business, finding the right buyer at the right price takes time. You want multiple interested parties to create competitive tension.

Phase 3: TRANSITION (2-7 Years)

Most sellers want to hand over the keys and walk away immediately, but that's rarely how it works. Buyers want continuity, and the type of deal often dictates transition expectations.

Transition timelines vary by buyer type:

Strategic buyers: Often want you for 6-18 months to ensure smooth handoff

Private equity: Typically 2-3 years, sometimes with equity rollover for a "second bite of the apple"

Management buyout or family succession: Can be gradual over 3-7 years

Why it matters:

Your freedom doesn't arrive the day you sign. Plan for how long you're willing (or required) to stay involved post-sale.

The Bottom Line:

If you're even considering exit in the next 3-5 years, you should start preparing now. Value and freedom rise together—and both take time to build.

Why Do Owners Decide to Sell?

Exit isn't just one decision—it's the result of evolving circumstances, shifting priorities, and strategic timing.

Understanding the common triggers can help you recognize when you're approaching your own inflection point.

Whatever your reason for considering exit, starting the preparation process early gives you control, clarity, and maximum value when the time comes.

Reason 1: Burnout & Timing

Most founders hit peak performance around year 7 or 8.

After that, energy and innovation often start to dip. The passion that built the business turns into exhaustion—and many owners start thinking, "I've climbed this mountain… do I really want to do it again?"

Reason 2: Personal & Lifestyle Factors

Sometimes the decision isn't about the business at all - it's about life.

Health issues, family priorities, aging parents, or simply the desire for balance can shift your perspective. What you valued at 35 looks very different at 55.

Reason 3: Financial Pressure

Years of reinvesting profits or drawing a modest salary take their toll.

Many founders exit to finally turn sweat equity into real financial security - to de-risk their personal wealth and diversify beyond the business.

Reason 4: Desire for What's Next

Entrepreneurs are builders at heart. Once you've scaled one mountain, you might start eyeing the next. The creative itch to start something new often becomes the strongest motivator of all.

Is Your Business Ready?

Buyers evaluate businesses through a specific lens—8 key drivers that determine valuation multiples, buyer interest, and deal structure. These drivers come from the Value Builder System™, which has assessed over 80,000 businesses worldwide.

The 8 Drivers of Company Value:

Financial Performance — Consistent, growing profits with clean, auditable financials

Growth Potential — Clear path to expansion without hitting immediate ceilings

Switzerland Structure — Business doesn't depend on any one person (including you)

Valuation Teeter-Totter — Balance of cash flow today vs. equity value tomorrow

Hub & Spoke — Documented processes and systems that anyone can follow

Customer Satisfaction — High retention, low churn, NPS that proves loyalty

Recurring Revenue — Predictable income streams (subscriptions, contracts, retainers)

Monopoly Control — Unique market position, differentiation, defensible moat

Why These Matter:

Two companies with identical revenue and profit can sell for wildly different multiples based on how they score across these drivers. Improving even 2-3 of these can double your valuation.

Two Types of Readiness: Business + Personal

Are You Personally Ready?

Business readiness is only half the equation. Personal readiness determines whether you'll wake up the day after closing with pride and purpose—or regret and emptiness.

The 4 Keys to Personal Exit Readiness:

Future Vision — Why you're exiting, and what's next.

Do you have a compelling "toward" vision, or are you just running "away from" the stress?Flexibility — Knowing your financial thresholds.

What's your "freedom point"—the number you need to never work again?Do you understand deal structures, tax implications, and how much cash vs. equity rollover you're comfortable with?

Personal Detachment — Building life outside the business

Is your identity wrapped up in being "the CEO"? Do you have relationships, hobbies, purpose outside of work?Team Involvement — Continuity for employees and clients

Do you care about what happens to your team and customers after you're gone?Buyers who share your values and vision create smoother transitions and better outcomes for everyone involved.

Strengthen these four areas, and regret drops away.

How Exit Planning Actually Works

Exit planning isn't a single event.

It's a systematic process that unfolds over 12-36 months, depending on your starting point & timeline goals.

-

Before you can improve, you need to know where you stand. This includes:

Value Builder Score™ — Comprehensive assessment of your business across the 8 key drivers of value, with industry benchmarking

Personal Readiness Score (PREScore™) — Evaluate your emotional, financial, and strategic readiness to exit

Estimated Current Valuation — Understand what your company is worth today and what levers can increase that number

You can't improve what you don't measure.

-

With your baseline established, you'll create a prioritized action plan that addresses:

Business Readiness:

Reducing owner dependency (systems, delegation, leadership team development)

Strengthening financial performance and cash flow

Diversifying revenue and customer base

Documenting processes and building recurring revenue models

Personal Readiness:

Clarifying your "what's next" vision

Calculating your freedom point and financial thresholds

Building identity and purpose outside the business

Defining your ideal buyer profile and deal structure preferences

This roadmap integrates Value Builder (exit readiness) with Scaling Up (operational excellence) to ensure you're building a business that's both valuable AND enjoyable to run.

-

Exit planning isn't about massive overnight transformation—it's about consistent, focused execution over 12-36 months:

Quarterly priorities aligned to your highest-impact value drivers

Monthly accountability to track progress and adjust course

Ongoing coaching and support to navigate decisions and remove roadblocks

The same disciplines that prepare you for exit also improve profitability, reduce stress, and give you freedom today.

-

When you're 6-12 months out from actively pursuing sale:

Engage an M&A advisor or broker to create your Confidential Information Memorandum (CIM)

Identify and approach potential buyers (strategic, PE, independent, management team)

Field offers and negotiate Letters of Intent (LOI)

Navigate due diligence process

Structure final deal terms and transition plan

Throughout this phase, your exit planning work pays dividends—because buyers see a business that's organized, transferable, and valuable.

-

Post-close transition periods vary by buyer type:

Strategic buyers: 6-18 months

Private equity: 2-3 years (often with equity rollover)

Management/family buyouts: 3-7 years (gradual handoff)

With proper planning, this transition feels intentional—not overwhelming.

The Bottom Line:

Exit planning is strategic, systematic, and starts years before you're ready to sell. The earlier you begin, the more options and value you create.

Exit Planning Solutions

-

Self-Guided Exit Planning Program (DIY with Tools)

Who It's For:

Business owners under $2M in revenue OR those who want to start preparing for exit on their own timeline with structured guidance, templates, and assessments—without the commitment of ongoing coaching.What's Included:

Value Builder Score™ assessment with personalized report

Personal Readiness Score (PREScore™)

Access to exit planning tools, templates, and frameworks

Video modules on the 8 drivers of value

Implementation roadmap and action checklists

18-month access to all materials

Best For:

Self-motivated owners who are earlier-stage, budget-conscious, or prefer to learn independently and implement at their own pace. -

Exit Readiness Mastermind (Group Coaching)

Who It's For:

Established business owners ($2M-$5M revenue) who want to prepare for exit—or discover they'd rather stay and run their business differently. Either way, you'll be ready. Ideal for owners who value peer insights and community support.What's Included:

12-month confidential mastermind with industry-exclusive cohorts (no direct competitors)

Integration of Value Builder (exit readiness) + Scaling Up (introduction to growth concepts and tools)

Monthly sessions focused on the 8 Value Drivers

Quarterly half-day workshops on the 4 Scaling Up decisions (People, Strategy, Execution, Cash)

Private 1-on-1 kickoff and exit readiness review sessions

Continuous implementation support via Teams channel

18-month access to all materials

Best For:

Owners who thrive in community settings, value diverse peer perspectives, and want structured accountability with expert guidance. -

Value Acceleration Coaching (1-on-1)

Who It's For:

Established business owners ($5M+ revenue) who want individualized advice, a customized roadmap, and active hands-on coaching tailored to their specific business challenges and exit timeline.What's Included:

Private 1-on-1 coaching

Customized Value Builder assessment and roadmap

Personal Readiness Score (PREScore™)

Integration of Value Builder + Scaling Up frameworks

Flexible engagement based on your priorities and timeline

Best For:

Owners who prefer individualized attention, have complex situations requiring custom solutions, or want maximum flexibility in their coaching relationship.

The Best Time to Prepare Was 3 Years Ago.

The Second-Best Time Is Today.

Here's the uncomfortable truth: most business owners wait until they're burned out, facing a health crisis, or receiving an unsolicited offer before they start thinking about exit. By then, they're negotiating from weakness—not strength.

What Happens When You Start Early:

You maximize valuation — Small improvements across the 8 drivers compound over time, often doubling your exit multiple

You gain leverage — When you're not desperate to sell, you can walk away from bad offers and wait for the right buyer

You reduce regret — Personal readiness work ensures you know what you're moving toward, not just running away from

You might not sell at all — Many owners fall back in love with their business once it stops running them

The Freedom Paradox:

The moment your business is truly ready to sell is often the moment you no longer feel like you have to. That's optionality.

30 minutes. No pressure. See what exit planning could look like for you.

Your Business Is Your Biggest Asset. Treat It That Way.

Not ready to commit yet? Start here.

Download “The Overlooked Owner”

Free Ebook

How do you determine the value of your business? Most owners think it's all about the numbers—revenue, profit, market conditions, assets.

But a study of 1,511 companies uncovered an often-overlooked factor that significantly impacts both company value AND exit satisfaction: the business owner themselves.

Your personal readiness—emotional, financial, and strategic—can make or break your exit. Or help you discover you'd rather stay.

This eBook reveals:

The 3 categories of exit motivations (and which one is driving you)

How to calculate your "Freedom Point" so you know your financial number

Why personal readiness matters as much as business readiness for successful exits

The biggest mistakes owners make when planning their exits (and how to avoid regret)

How to know if you're emotionally ready to let go—or if you'd rather fix what's broken

Valuable insights to help you think through your options